Best Options Trading Books You Should Read in 2024

Pro tip: A portfolio often becomes more complicated when it has more investable assets. That’s why we recommend a pure crypto app, like Binance. Hodl Hodl is a good option for you in that case. This is the difference between the buy offer and sell bid prices, which are wrapped around the underlying market price. Closing Session open time: 12:40 hours. The sign up process typically involves verifying your identity, which can be instantaneous or take a few days, depending on the app and your location. A company can list itself in both BSE and NSE or on either one out of the two. We consulted financial planners, investing experts, and our own wealth building reporter to inform our picks for the best stock trading apps. Note that for the simpler options here, i. Countries such as South Korea, South Africa, and India have established currency futures exchanges, despite having some capital controls. Sign up to Bybit crypto exchange and earn huge Bybit Referral Code Rewards of up to $30,000. If so, you have a potential entry point for a strategy. Some apps give you stock you’ve never heard of or would never buy. In London, puts and “refusals” calls first became well known trading instruments in the 1690s during the reign of William and Mary. This is a gem that encompasses investor psychology and system construction. Simulated performance does not ensure success in a live environment. For example, you can invest in ETFs and over 800+ stocks while retaining full ownership. “the BD”, member of FINRA and SIPC. As part of our data check process, we sent a data profile link to each broker summarizing the data we had on file and the data they provided us last year, with a field for entering any data that had since changed. This might sound too overwhelming for you, but don’t worry. Another aspect is the expanded availability of margin, which results in a higher level of leverage. You can refer to the below table to understand the difference between short term and long term options trading. There are mainly two ways to trade the Double Bottom Pattern. Dabba Trading, also known as bucketing or parallel trading, is primarily used in the Indian context. A long straddle strategy involves buying a call and put option for the same asset with the same strike price and expiration date at the same time. Good to know: Firstrade pays low interest on uninvested cash and has more limited customer support hours than some brokers on this list. Managing Your Cookie Preferences. In this article, you’ll learn how scalping works, what a 1 minute scalping strategy is, and several approaches that you can adopt. Success mantra: Traders need to be self disciplined and should be able to overcome greed. However, if you are not interested in trading and only wish to invest in IPOs and futures and options trading, you can go for only a Demat account.

Is it Better as a Main or Complementary Strategy?

Those include everything from personal financial planning to insurance, estate planning, retirement planning, accounting services, tax advice, and more. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. In this case, you’ve earned a profit of 100% on your initial margin deposit $34 x 10 shares = $340. Hi Mark, Bitcoin Evolution is pretty much a sure way to lose money, and as close as you can get to being a scam without being one outright. Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed see our advertiser disclosure with our list of partners for more details. Patience is key when learning to become a successful trader, and mistakes and losses are inevitable in order to grow and develop your trading skills. 5 and volatility falls to 23. Thus, buying a lot of OTM options can be costly. An option on an SandP 500 futures contract, therefore, can be though of as a second derivative of the SandP 500 index since the futures are themselves derivatives of the index. Ссылка на индикатор будет находиться в приветственном письме. Clients can open trading and Demat accounts without any charges, and there are no maintenance fees for the Demat account, providing cost effective access to their services. The aim is to transfer the indirect expenses and indirect revenue accounts to the profit and loss account. Discover the fundamentals of options trading, including: what are options, which markets you can trade, what moves options prices, and how to get started with options trading. Find out more with my day trading guide. View NerdWallet’s picks for the best brokers. Book: Alchemy of FinanceAuthor: George Soros. Graham reminds traders that their biggest obstacles often come from within, such as fear and greed. Navigating the dashboard and platform is not as easy as it could be, so it’s easy to make the argument that TradingView is not as accessible as some of the other paper simulators we’ve taken a look at. Of course, in today’s era of capital markets, price manipulation has increased and possibilities of stop loss hit has increased because of which the retail participant often avoids placing one. Lastly, any technical issue might hinder your buying or selling process, which can cause severe delays.

Rules of the road

Investing in over the counter www.trading-option-ng.xyz derivatives carries significant risks and is not suitable for all investors. While tick charts differ in their measurement approach, the basic principles of reading them share similarities with traditional charts. You can sign up in minutes, buy on the go, and check how your stock is doing at a glance. This value is obtained from the balance which is carried down from the Trading account. Featured Partner Offers. The maximum reward is theoretically unlimited to the upside and is bounded to the downside by the strike price e. Traders may often place a trade hoping that the market will swing their way, but the reality is that they may have missed key trading practices and checks that would have enabled them to minimise their risk. This information is only for consumption by the client, and such material should not be redistributed. However, your maximum risk is potentially unlimited if the market moves in favour of the option holder. Numerous studies show that when the retail investor engages in impulse investing and frequent trading he or she ends up with lower than average returns. CMC Markets’ mobile app is cleanly designed and comes packed with research tools, powerful charts, predefined watchlists, integrated news and educational content, and much more. While Quotex remains claiming that it is operated by Maxbit LLC, which is registered in St. Brokerage services are offered through Robinhood Financial LLC, “RHF” a registered broker dealer member SIPC and clearing services through Robinhood Securities, LLC, “RHS” a registered broker dealer member SIPC.

Can candlestick patterns be applied to all time frames, such as daily, hourly, and minute charts?

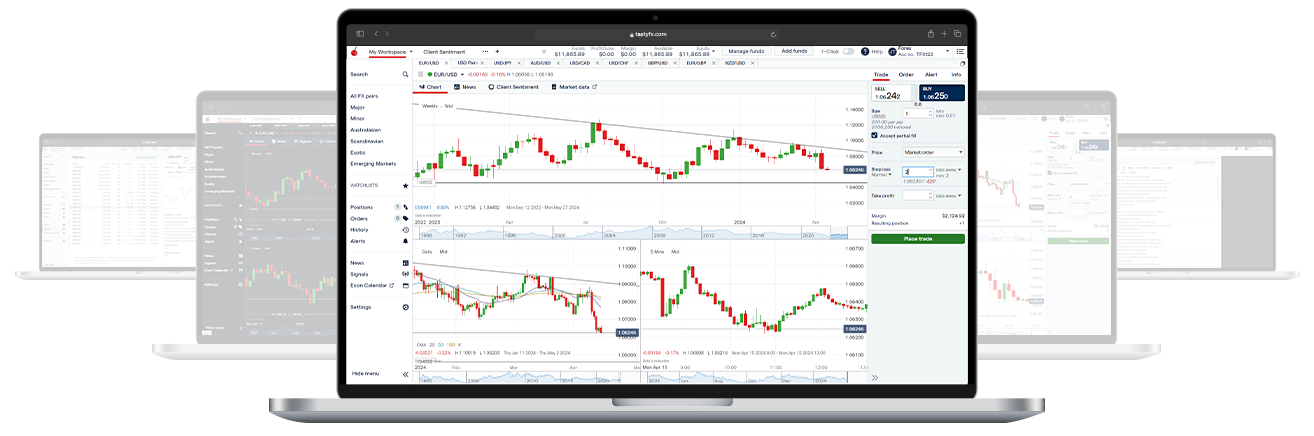

Com have seen stock trading apps evolve from basic watch lists to fully functioning stand alone trading platforms. Moreover, it is advantageous because it helps ensure prices stay close to the true value while providing better opportunities for smaller investors. This message is not intended as an offer or publication or solicitation for distribution for subscription of or purchase or sale of any securities or financial instruments to anyone in whose jurisdiction such subscription etc. Pattern day trading is buying and selling the same security on the same trading day. Exploring different trading types allows individuals to optimise their trades effectively. Forbes Advisor weighted each of these categories in accordance with their importance to various types of investors to compute the best app for each specific type of investor. In effect, this strategy puts floor below which you can’t lose more. Direct Expenses: Direct expenses are the costs directly connected with the production of your products or services. Understand audiences through statistics or combinations of data from different sources. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. They do not trade actively, with most placing fewer than 10 trades in a year. Telephone calls and online chat conversations may be recorded and monitored. Over time, individual candlesticks form patterns that traders can use to recognize major support and resistance levels. Heikin Ashi is a candlestick chart with modified open, high, low, and close prices. If the writer also owns the underlying stock, the option position is covered. Day trading for Beginner: Open a trading account, research stocks and grasp market fundamentals for successful trading. Fractional shares only available through a robo advisor portfolio or dividend reinvestment plan DRIP. Trendlines will vary depending on what part of the price bar is used to “connect the dots.

18 Sep

In our world, you also get great value for money. Investments can fall and rise. Meaning: An inside bar shows a temporary pause in trading activity, usually after long trends or before the creation of a new trend. In addition, you need to be more flexible especially when it comes to trades that are not working in your favor. Furthermore, you can control your risk by either mirroring the provider’s level of risk and position size or by setting a fixed size per trade. 3 Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. Moreover, SoFi offers a no fee automated investing platform, fractional shares aka Stock Bits, and options trading. Intraday trading are very risky due to high price fluctuations. Based on this change, traders buy or sell securities. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. Identifying these patterns and understanding what they imply about future price action helps traders spot opportunities to go long on a stock in anticipation of further gains. Frederick says to think of options like an insurance policy: You don’t get car insurance hoping that you crash your car. Now here, in this section, we are going to outline the specifications of the ECN Commission free account. On September 12, 2024, the Security and Exchange Commission SEC announced that eToro is ceasing trading for nearly all crypto assets. Derivatives Resources. Purchasing and selling securities listed in a stock exchange on the same day is known as intraday trading. But it also carries a higher risk compared to the delivery segment.

1 Premium

Having a trading account on a trusted Forex platform allows you to set rules that safeguard your investments. 00 appeared as a strong resistance level on an hourly chart. A long put butterfly spread is a combination of a short put spread and a long put spread , with the spreads converging at strike B. EToro is trusted by millions of users worldwide and is regulated by nine financial authorities, including CySEC, FCA and ASIC. The huge number sounds impressive, but a bit misleading. Here is how you can read a tick chart and interpret it in a simple way. Most of these instructors will have practical experience in stock market trading and investing, making their presence extra valuable for students looking to find work in the financial sector. Here’s one from Bill Lipschutz, one of the best traders of all time. Doing so requires combining many skills and attributes—knowledge, experience, discipline, mental fortitude, and trading acumen. Countries like the United States have sophisticated infrastructure and robust regulation of forex markets by organizations such as the National Futures Association and the CFTC. As the structure forms, you expect to see higher lows and lower highs.

Find a better broker

With position trading, on the other hand, you’re looking at longer term plays. Yet, some day traders might consider these smaller fluctuations “tradable. The Cup and Handle pattern is a bullish trend continuation pattern that typically signals a strong upward movement. Com have seen stock trading apps evolve from basic watch lists to fully functioning stand alone trading platforms. Best crypto trading app everI like day trading in good crypto because you get all the great features in there. Get an understanding of the steps involved in placing a trade, including how to protect yourself against risk and use leverage wisely. When trading with us, you’ll be using leveraged derivatives known as CFDs to trade on margin. Very little market risk is involved. When the Aroon Up crosses above the Aroon Down, that is the first sign of a possible trend change. Download one of these apps today and embark on your investment journey with confidence. Use profiles to select personalised content. The integration of tick charts with volume data offers traders a strategic advantage. I am not in the US, nor does my UK address have anything to do with the US. Traders closely tracking a specific asset can receive push notifications when it reaches a set price or moves by a fixed percentage. 05% whichever is lesser for each executed order. I contacted customer services by email and received no reply for days. Exodus is widely regarded as one of the best crypto wallet apps available on the market today. The hanging man candlestick pattern is a bearish trend reversal pattern. Call +44 20 7633 5430, or email sales. The app is easy to use, low cost, and offers a decent interest rate on uninvested cash.

Best Online Brokers for Day TradingPreviously Read4 MIN READ

Color trading is not just about owning a digital shade; it’s about participating in a new form of digital commerce that blends art, creativity, and investment. Write down your private keys and store them safely: Remember, your ‘private keys’ and your ‘seed phrase’ can be used to access your wallet. Do your due diligence and understand the particular ins and outs of the products you trade. It also offers fractional shares, which are a great way to dip your toe into stock trading. Support and resistance levels are often useful information when determining a course of action. Nil account maintenance charge after first year:INR 199. Many professional money managers and financial advisors shy away from day trading. These resources can help traders improve their skills, stay informed about market trends, and make more informed trading decisions. 70% of retail client accounts lose money when trading CFDs, with this investment provider. 25 premium reduces the cost basis on the shares to $43. Could be a bit easier to learn. Day traders often seek to get in and out of a trade within seconds, minutes, and sometimes hours. Holding on to the hopes that the market will act as you predicted it to can increase your losses. This is the reason it’s considered a contrarian investment strategy. Difficult to connect with a live product specialist. » Market Holidays » 2024 NSE Trading Holidays. Traders use different chart compositions to improve their ability to spot and interpret trends, breakouts, and reversals. Right click on the chart > select Format Symbol > go to the Settings tab > under ‘For Volume Use’ you’ll see a pull down menu > change the setting from Tick Count to Trade Vol. Here’s the profit on the short put at expiration. Kovner underscores the importance of using all available tools, like charts, to make informed trading decisions. Quite simply, it’s the global financial market that allows one to trade currencies. Information contained on this website is general in nature and have been prepared without consideration of your investment objectives, financial situations or needs. The 100% goes at the bottom of the move and the 0% at the top because price is rising. In fact, you’ll need to give up most of your day. A stop loss ensures that the losses are kept at a minimum while you strive to generate disproportionate profits. Contract that gives you the right to sell shares at a stated price before the contract expires.

Details Cookies

Trading is done both over the counter OTC and on regulated and centralised exchanges such as the Chicago Mercantile Exchange CME. Do you want a great mobile app to check your portfolio wherever you are. Scholars, including us, are pursuing many avenues of research on insider trading, such as how insider trading restrictions are determined and how insider trades inform markets when news is limited. At The Robust Trader, we use Tradestation, Multicharts, and Amibroker. Customers holding cryptocurrency no longer offered by eToro will be able to sell their cryptocurrency for up to 180 days. I think this is a excellent insider’s view of the business of trading and marketing derivatives. I had already budgeted the profits I was going to withdraw and was really looking forward to it when I came across this page and was forced to have a rethink about the whole thing cos it felt like I was listening to someone who’s been where I was headed so l decided to try for a withdrawal. “How do I find stocks in the platform. However, it should be noted that price differences when using this strategy are tiny, and the spread could adjust to lower levels if this strategy is implemented by several traders. Trinkerr is not liable for any gains or loss of capital. Sadly what started as a great little app has now become a total mess following a shift to Tradinview for charts. Click here to get started. “And again, it gets you out of thinking that you’re gonna be so smart, that you’re going to be able to pick the stocks that are going to go up, won’t go down and know when to get in and out of them.

Mutual Fund

Get greater control and flexibility for peak performance trading when you’re on the go. The profit and loss account provides information about an enterprise’s income and expenses, this results in the net profit or net loss, which helps a businessman to evaluate the performance of an enterprise and provides a basis for forecasting the future performance. Trading involves risk and can result in the loss of your investment. It provides educational materials, maybe even demo accounts and easy to understand charts and features to help beginners learn the basics of trading without feeling overwhelmed. IG also offers spread betting, Investment Trusts, and Managed Portfolios. Once the closing price is in the second rebound and is approaching the high of the first rebound of the pattern in other words, the middle of the “W”, a noticeable expansion in volume is coupled with fundamentals that indicate market conditions are conducive to a reversal. Staking is another option for those who have significant crypto assets and want to hold them but at the same time accrue more value. A financial professional will be in touch to help you shortly. The idea is that you can build a big trading account by taking lots of smaller profits over time just as easily as placing fewer trades with longer timeframes. Com is the premier provider and one stop shop for dividend information and research. A reversal trade setup involves identifying potential trend reversals in the forex market. You’ll still get dividends if a company decides to pay them which is when a company pays out its profits to its shareholders. Index options generally trade “European style,” which means the settlement process is done at expiration only, which can be based on the value of the index at market open or market close. Home » Investing » What are the Best Trading Apps in 2024. The word ‘dabba’, meaning ‘box’ in Hindi, symbolises this practice’s unregulated and hidden nature. This helps the company know how much money it has from trading activities. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. 1 Closing stock valued at ₹ 44,000. For example, you might be more interested in staking rewards if you’re interested in passive income. Of any of the Rules, Regulations, Bye laws of the Stock Exchange, Mumbai, SEBI Act or any other laws in force from time to time. However, that does not mean that there are no options. Reddit and its partners use cookies and similar technologies to provide you with a better experience. Noble Desktop offers a wide range of classes ideal for students hoping to learn stock market investing for private or professional purposes. Tim Maunsell is Blueberry Markets’ senior member of the Customer Experience team, with over a decade of experience in the global forex market. Ally Invest has a lot that investors will like, such as its commission free stock and ETF trades, 24/7 customer service and trading platform, which more active traders will appreciate.

How Is Gold Price Determined in India?

Measure advertising performance. You’re covered up to £85,000 per company, and basically if the company goes out of business and doesn’t give you your money back, the FSCS will. Written by Michael Lewis, the narrative revolves around a few main players who bet against the subprime mortgage market and ended up profiting from the financial crisis of 2007 to 2008. Trendlines provide a simple and useful entry and stop loss strategy. Minimum Withdrawal: ₹200. It provides users with a virtual cash balance of 10 lakh rupees to invest in stocks, mutual funds, commodities, and more. Now, let’s say a call option on the stock with a strike price of $165 that expires about a month from now costs $5. Tharp’s approach is centred on traders tailoring their strategies to their individual goals, risk tolerance, and trading styles. What are Futures/ Futures Contracts. All days: 8 AM to 8 PM. “Requirements for Algorithmic Trading. Black box algorithms are not just preset executable rules for certain strategies. Please note that by submitting the above mentioned details, you areauthorizing us to Call/SMS you even though you may be registered under DND. There is no difference between forex trading and currency trading, as both mean that you’re exchanging one currency for another. The cover isn’t impressive, but if you know what to look for, you may be able to get this one for cheap at a garage sale or library sale. Best Online/Execution Only Stockbroker. More individuals and families are hiring personal chefs to cook in private settings. Expiration DateThe expiration date is the date on which an option expires. Vyapar comes out to be an excellent tool that streamlines the invoicing process.

IronFX

Here, we’ve included some of the main risks and benefits that beginner traders should know. Investment management firms who typically manage large accounts on behalf of customers such as pension funds and endowments use the foreign exchange market to facilitate transactions in foreign securities. Individual day traders face steeper challenges, competing against these institutional players and high frequency trading HFT algorithms that can execute trades in microseconds. It was developed by a TradingView user and was used in conjunction with ADX and Di which another user developed. English, Arabic, Czech, Danish, Dutch, Finnish, French, German, Italian, Norwegian Bokmål, Polish, Portuguese, Romanian, Russian, Simplified Chinese, Spanish, Swedish, Traditional Chinese, Vietnamese. However, some stock trading apps have minimums. Alternatively, some robo advisors charge a percentage of the assets you have in your account, with yearly rates up to 0. A mix between travel writing and investment advice, the book has piqued the interest of motorcycle enthusiasts and market participants alike. 60% of retail investor accounts lose money when trading CFDs with this provider. Retest of the break of the neckline is a prominent confirmation alongside other confluences. Investopedia collected and analyzed several criteria that are the most important to readers choosing the right mobile app to fit their investing and trading needs. Trading strategies can be stress tested under varying market conditions to measure consistency. If it finds that the pattern has resulted in a move upwards 95% of the time in the past, your model will predict a 95% probability that similar patterns will occur in the future. The final output produces star ratings from poor one star to excellent five stars. Best Broker for Stocks.

Trading instruments

Option HolderAn option holder is the purchaser of an options contract. This is because the market tends to be volatile during this period. Trading in financial instruments involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. To succeed in AI investing, traders need to have access to a variety of tools. Here are some common terms a trader needs to know before trading forex. He makes six figures a trade in his own trading and behind the scenes, Ezekiel trains the traders who work in banks, fund management companies and prop trading firms. BA and Honors in Public Diplomacy and Affairs, The Raphael Recanati International School Reichman University DPIJI, Daniel Pearl International Journalism Institute HarvardX. Advanced traders will find a powerful lineup of algorithmic trading features in Interactive Brokers’ pre built algos, a laundry list of API languages, available algorithmic paper trading accounts, and so much more. Stock traders will especially appreciate its top notch research tools, renowned trading platform and very strong customer service. The book is cited as a major source of learning by the traders in Jack Schwager’s ‘Market Wizards’, while former Fed Chairman Alan Greenspan describes it as a ‘font of investing wisdom’. Account opening charges. Moving averages help you determine the trend of the stock and also give you clear signs of a trend reversal. Check if stock exchanges in India are open today. You should consider whether you can afford to take the high risk of losing your money. You can then sign up for the right tools that help with intraday trading.